new technology stock: When you’re a new investor, you may not know where to start looking for new technology stocks. But there are many booming new businesses in the sector. For example, there are a number of renewable energy companies. These include companies like Lumen Technologies, Enphase Energy, and SolarEdge Technologies.

Lumen Technologies

Lumen Technologies is one of the most promising new technology companies. Its stock has been in transition for three years, and it has finally turned profitable after three years of net losses. The company’s stock is down 15% year-to-date, but its first-quarter results were quite impressive. Its reported 63 cents per diluted share (EPS) GAAP, beating estimates by 18 cents, and it had revenues of $4.68 billion, which was above consensus. Reported a net income of $599 million for the first quarter of 2022.

The company recently announced a $2.7 billion deal with Stonepeak to divest its Latin American operations. This deal will add another $800 million to the company’s revenue. The remaining long-haul fiber business should have a value of $20 billion or more once the deal closes. While Lumen’s stock remains undervalued today, it could see big gains in the coming months as it executes its growth plan.

Technologies, new technology stock

Lumen Technologies is a technology company focused on providing integrated communications to business and residential customers. It has two reportable segments: the Business segment and the Mass Markets segment. The Business segment focuses on delivering products and services to enterprise and commercial customers. The company also has a wholesale business.

The company has a reputation for being a good capital manager. In the past, operating expenses were $6.91 billion in LTM, down 17.6% from FY2019 levels of $8.39B. This has lowered the company’s cost-to-revenue ratio, which was 35.7% in LTM. The company has continued to focus on the customer experience and improving the business model as a whole.

Although Lumen’s Q1 2022 earnings report was mixed, the company’s outlook was upbeat. However, there is still a debt issue. The company’s business model revolves around helping companies leverage the power of edge computing and hybrid cloud. The stock began the year at nearly $13 but has fallen steadily over the past several months. Wall Street has generally dumped tech stocks due to concerns about interest rates and supply chain problems.

See also: new Technology Stock

Enphase Energy

Enphase Energy (NASDAQ: ENPH) is building an integrated product suite for residential electrification. The company has built an extensive installer network in the US and has contracted with manufacturers in India, Mexico, China, and Romania. Enphase’s pipeline of products is impressive and its technology is cutting-edge.

The company’s growth has been driven by the popularity of solar energy. Favorable federal policies, rapidly falling costs, and the burgeoning green energy industry are driving the market for solar power. It is expected that as many as 121 gigawatts of solar capacity will be installed nationwide by March 2022.

Enphase Energy has been a spectacular stock performer over the past couple of years. It has escaped the tech sector’s valuation reckoning and has established itself as a leading energy management company.

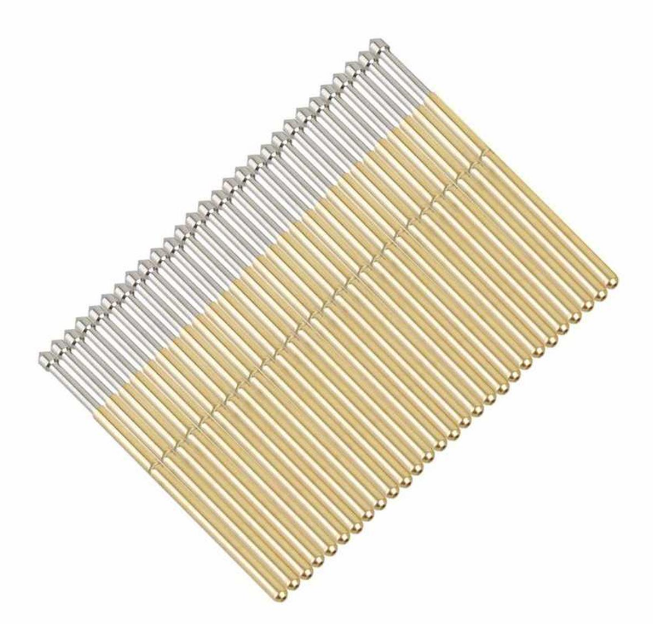

Taiwan Conductor

Taiwan Conductor’s new technology stock is a semiconductor maker that is growing at a fast pace. There are many positives about this stock, including its stock price, but there are also some disadvantages, too. First, investors need to understand the risks involved in buying this stock. China’s threats to Taiwan’s sovereignty are higher than they’ve ever been. Second, the stock’s valuation is bullish, which may not hold up in two or three years.

Taiwan is a small island with 23.5 million people, but it plays a critical role in America’s national security. It is a close technological partner and strategic ally. Its technology companies help the United States remain competitive in advanced technology industries. This is a big reason why U.S. companies depend on Taiwanese companies to produce their semiconductors.

TSMC is a semiconductor company with a strong presence in the U.S. It is also one of the biggest contract semiconductor suppliers on the planet. The company’s chips are used in personal computers, industrial equipment, and consumer electronics. However, it is a smaller company that doesn’t have the same market share as the larger companies. Despite that, investors may want to consider this stock if they’re interested in the semiconductor industry.